The thought of homeownership, to many, may seem like a fantasy once accessible to previous generations that is no longer in reach. According to the National Association of Realtors, Baby Boomers are still the largest generation of homeowners in 2023, at 39%. Even if it were accessible, is it the right choice compared to renting? Let’s take a look at the pros and cons of homeownership.

Benefits of Homeownership

Stability- Financing a mortgage allows the monthly payment to stay nearly the same for the duration of the loan, which is generally 30 years. The only thing that will change is local taxes, adding to the monthly payment minimally compared to the rent hikes that come with inflation each year. The median single family home price in the U.S. in 1993 was $126,500. As of April 2023, the median price of a new single family home in the U.S. is up by 332.65% at $420,800 (U.S. Department of Housing and Urban Development). It’s hard to imagine a monthly mortgage payment of approximately $870 today, and if the market continues growing in the fashion it has over the last 30 years, homeowners now will be saying the same about their monthly payments secured in 2023.

Additionally, renters are at the mercy of landlords when the lease term renews. Unless there is rent hike protection in place, landlords may increase rent as much or as often as they choose. It is also the landlord’s prerogative to sell the home at the end of a lease, change rental management, or simply choose not to renew a lease, putting renters in a position in which they are required to find a new home. Homeownership allows for stability that relies only on the owner themselves.

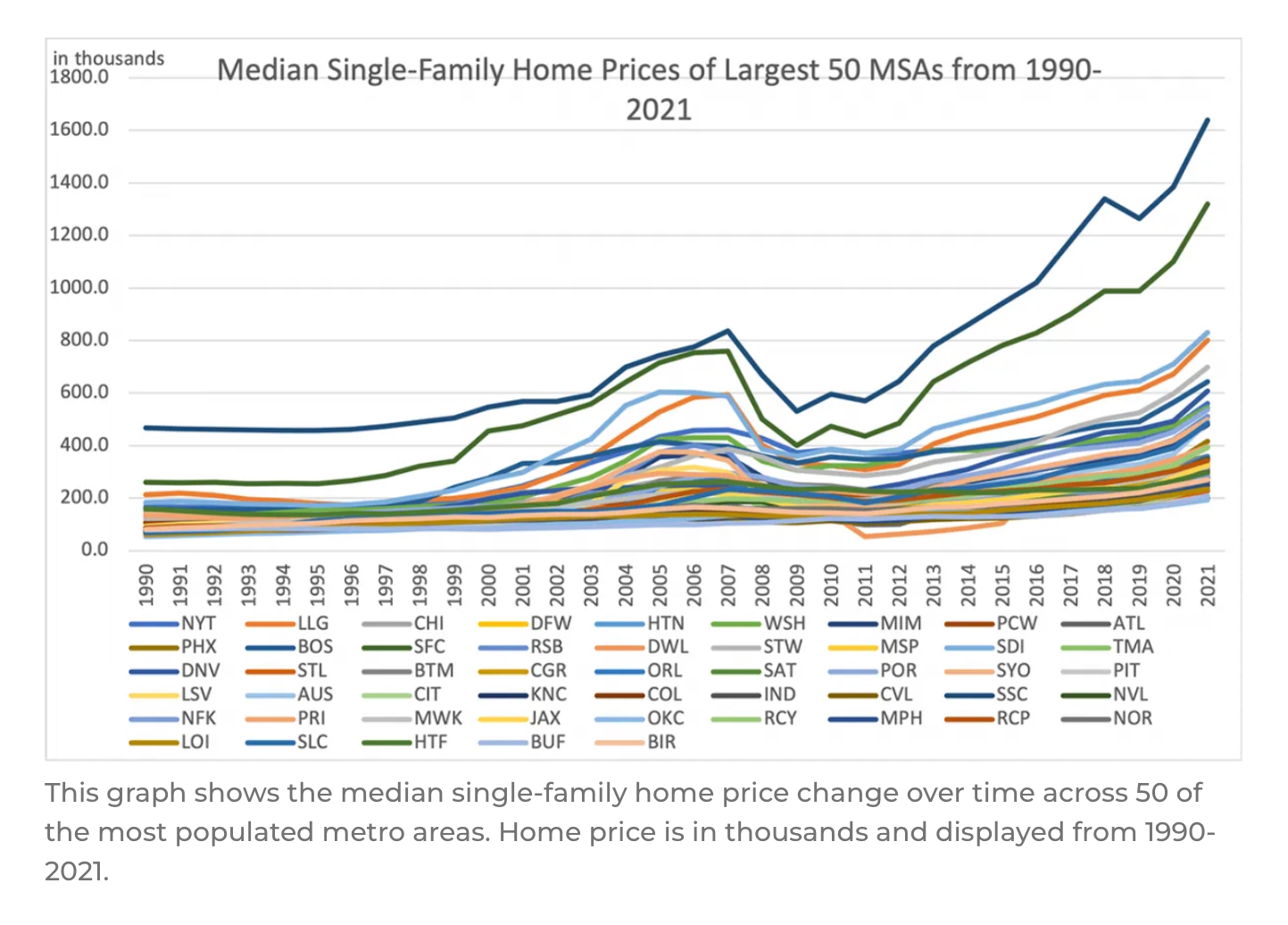

Equity- As previously mentioned, the median home price in the U.S. has risen phenomenally over the last three decades, leaving homeowners with equity in their home. Here is a chart outlining the appreciation of single family homes in metropolitan areas in the United States since 1990 (National Association of Realtors).

Investment- Simply put, a monthly payment toward housing will invest in one of two parties: landlord or homeowner. Since the payment is made regardless of lease type, investment in future financial stability is a benefit of homeownership.

Benefits of Renting versus Owning

While homeownership has many benefits, there are certainly circumstances that can make the process difficult.

Navigation- Going through the process of buying a home takes an abundance of steps, paperwork, and attention. Those seeking financing, which is a large portion of potential homeowners, go through the additional process of securing a home loan and property that meets the loan criteria. But even without the mortgage process, it can be difficult to ensure the transaction is completed in a timely and legal matter. Using a knowledgeable professional to aid navigation through a home purchase is a key part of accessing homeownership.

Financing- The biggest and most obvious obstacle facing homeownership is financing. Those purchasing a home are looking at inspection, appraisal, and closing fees in addition to the down payment needed to secure a mortgage loan. A real estate professional can help those seeking homeownership with resources to aid down payment and fees associated with purchasing a home.

If homeownership sounds right for you, please allow me to help you navigate the process and find you the perfect home. It is my goal to assist through relationship, proficiency, efficiency, and service. I’ve attached resources for down payment and closing cost assistance below as well as my contact information.

Down payment assistance/ loan programs:

-

- HUD housing programs: https://www.hud.gov/states/florida/homeownership/buyingprgms

- State Housing Initiatives Partnership (SHIP) program, find local contact information here: https://www.floridahousing.org/programs/special-programs/ship—state-housing-initiatives-partnership-program/local-government-information

- Florida down payment assistance programs: https://apps.floridahousing.org/StandAlone/FTHBWizard

- USDA, check map of eligible areas here: https://eligibility.sc.egov.usda.gov/eligibility/welcomeAction.do?pageAction=sfp

- HOME Homebuyer Assistance Program, find local contacts here: https://www.hud.gov/states/florida/community/home

- Pensacola Homebuyer Incentive Program, for more information go to: https://www.cityofpensacola.com/DocumentCenter/View/5491/City-of-Pensacola-Affordable-Housing-Incentive-Plan-PDF

Contact me!

Isabelle LoPresti Dueck, Realtor

(907) 854-7310

Isabelle.LoPrestiDueck@31southrealty.com